Your De Facto Chief Investment Officer (CIO)

Why is The Advisors' Tamp the "Anti-TAMP?"

Reason #1—VETTING! Most TAMPs in the marketplace (and you know the usual suspect), have little to no vetting process. They throw typically hundreds of 3rd party managers on a platform and let advisor fend for themselves (you have to learn each strategy and vet the manager’s process to and determine if it’s any good (a daunting task without being a CFA or having a team of CFAs to help).

At The Advisors’ TAMP, Joe and his team vet the managers and if they are not deemed worthy, they are NOT allowed on the platform.

Does that mean the managers on this platform will be awesome all the time? No, but it doesn’t mean that they have been through a “real” vetting process by one of the industry’s brightest minds before being added.

Reason #2—PRE-BUILT and MANAGED PORTFOLIOS! It’s one thing to determine that a manager is good. It’s another to determine how you mix and match managers together to build a portfolio designed to get the best outcome. This is what Joe does and it takes the burden off of an advisor and gives them confidence in the portfolios they are offering.

Integrated with OnPointe Risk Analzyer

Best point of sale tool in the industry today!

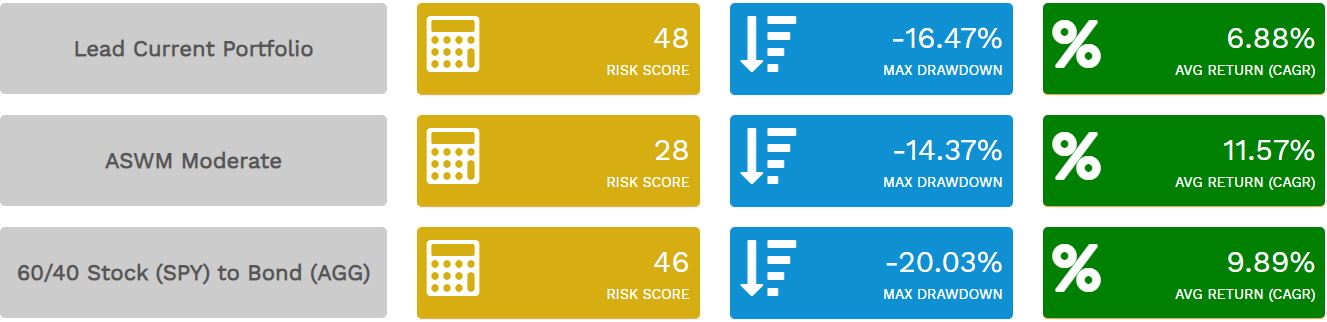

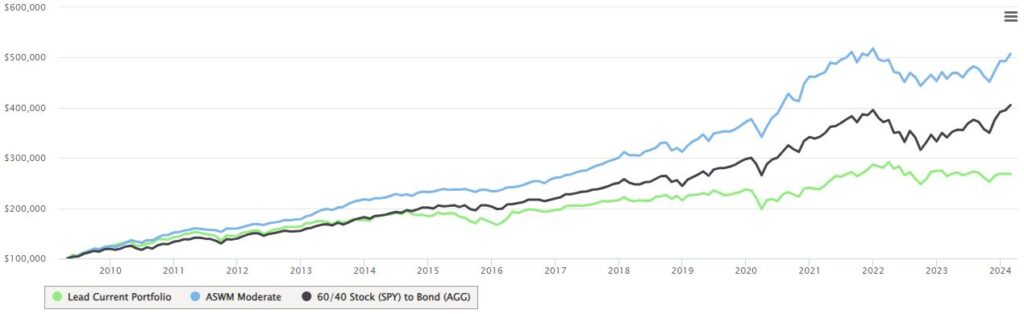

- Show a client their current portfolio

- Compare it to the closest industry benchmark

- Compare it to an ASWM TAMP strategy or multi-manager portfolio

- Which will client like better in this example? The green, black or blue line?

For compliance purposes, the above is an example for illustrative purposes only to show the power of working with a TAMP that is integrated with OnPointe Risk Analyzer. For more information on OnPointe Risk, click here.